By Bisi Bamishe

Despite the harsh operating environment in the country, Universal Insurance Plc has projected a premium income of N20 billion for the 2024 financial year.

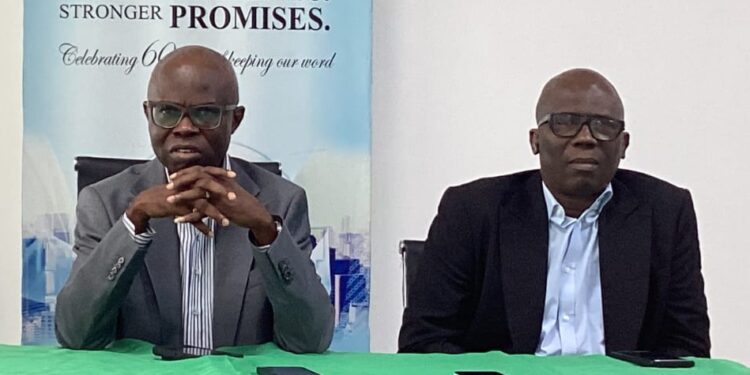

Managing Director of Universal Insurance, Mr. Ben Ujoatuonu made the revelation at the 2023/2024 Annual General Meeting (AGM) of the Nigerian Association of Insurance and Pension Editors (NAIPE) hosted by Universal Insurance in Lagos.

According to Ujoatuonu, all the company indices are showing positive signs and we will continue to sustain the tempo, adding that the Company has grown it’s Asset from N11 billion in 2022 to 17 billion in 2023.

He said: “I was here last year to brief NAIPE on what we have done, our projections and what we intended to do. I am here today to let you know that all that we set out to achieve for the end of the year 2023, by the grace of God, I will say we achieved 98% of them. The branches we intended to open, were opened and I told you that we expected to end the year with a premium income of about N10 billion. However, we ended the year with a premium income of N9.3 billion with profit of over N530 million.

“This year 2024, we started out with very high expectations. We are also looking forward to opening more branches in 2024. In 2024, we are projecting to end the year with a premium income of about N20 billion. It may interest you to know that as at today, we are doing about N9.3 billion in premium income. We are very optimistic that we are going to achieve it before the end of 2024.

“Our asset will also increase from N11 billion to about N17.5 billion and our shareholders fund will increase from about N9 billion to N12 billion. So all the indices for us are showing positive signs and we will continue to sustain it.”

Ujoatuonu stated that Universal partnership with NAIPE has added a lot of value to the company and they value it a great deal.

He said: “For so many years, when we go out into the market, one of the challenges we had was people asking, “Is universal still existing? That was a question we were getting then. But today with your cooperation, the projections and what we’ve been able to do in Universal as a brand, people now want to be part of it. People now want to identify with our company and we are grateful to NAIPE for putting us out to the public.

“Due to NAIPE’s support, we are getting into partnerships with a lot of groups and in various states and we are very hopeful that they will create the level of value we are looking forward to.

“At the end of the day, we are meeting our claims obligations and stakeholders are happy. In April when we had the brokers evening, it was very clear that the NCRIB endorsed universal insurance as a company to deal with in terms of service delivery and claims payment. We are sustaining that level of relationship with brokers. And we are very hopeful that it will continue to add the level of value we expect.”

Ujoatuonu added that Universal Insurance admitted three new directors into the board of directors from various backgrounds and diverse experience, stating: “We hope that their entrance into the board will also create the level of value that will expand our frontier in terms of business generation, among the rest of them. So we are on the move. And I believe that our partnership will continue to afford you the opportunity to dish out to the public what we’re cooking so that they will be able to feed from the abundance of good things coming out from Universal insurance. So we’re very grateful for this partnership. And we thank you for giving us the opportunity to come around.”