By Bisi Bamishe

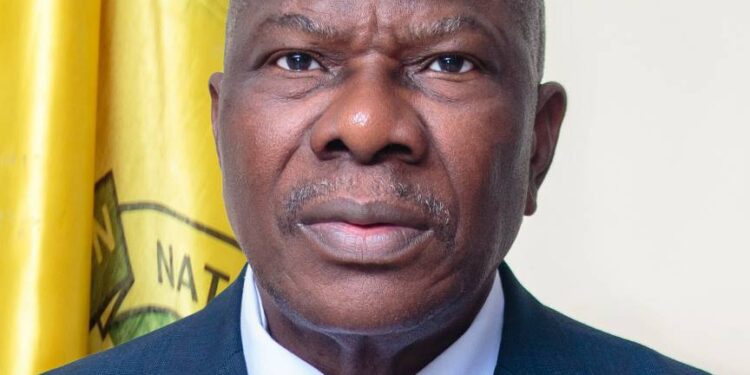

The Commissioner for Insurance Sunday Thomas, has made known that the insurance industry paid N550 billion as claims in half year 2023.

He said this today, while presenting a paper entitled; ‘Rethinking Insurance as a Critical Economic Growth Strategy’ at the Lagos Chamber of Commerce and Industry (LCCI) Insurance Group 2023 Insurance Stakeholders’ Consultative Forum in Lagos, adding that the industry paid N398 billion as claims in 2022.

He noted that analysing impacts of losses especially from the angle of paid claims reveals the extent of insurable adverse events leading to financial losses which if not insured would have slowdown the economic activities that galvanizes economic growth.

Thomas said all institutions including the government embark on strategies for maximizing revenue and optimizing expenditures which may constitute exposure to financial insecurity, stressing that insurance is often considered a first line priority in ensuring financial security as it serves as a component of risk management system that mitigates the impact of financial risk on entities, government, other institutions and individuals.- “So we think Insurance when our loss exposures are covered without aborting risk taking activities,” he submitted.

The insurance regulator noted that the FGN under the new leadership of the President, Bola Ahmed Tinubu had embarked on opening up the economy to developments of industries through diaspora partnerships, foreign direct investments and facilitating as well as enabling business environments in Nigeria.

He said accordingly, there can’t be attractions without institutions covering the risks associated with such openings to the world, the nation must therefore think Insurance when considering the risks of expropriation, currency inconvertibility, terrorism and sabotage, sovereign and sub-foreign obligor risks, protracted defaults and many other risks.

Thinking insurance in developmental process, he said enables investors concentrate on commercial aspects of investments whilst relying on the comfort of the cover provided by insurance institutions for pure risks not excluding political risks.