Thomas

By Tope Adaramola

Leadership often requires making unpopular decisions, but a skilled leader is also sympathetic to the feelings of others and takes care to avoid unduly upsetting or alienating anyone. Of course, this requires maturity, restraint and the exercise of imagination and good judgement on the part of the leader.

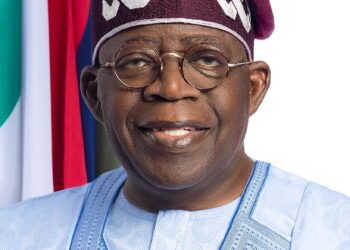

This apt words of Alan Axelrod in his celebrated book “Elizabeth I CEO” could not have better describe the leadership style of the Acting Commissioner for Insurance in Nigeria, Mr. Sunday Olorundare Thomas, in handling regulation of the insurance industry in the last couple of months.

It makes no news that the Nigerian Insurance Industry has been finding it difficult to get its rhythm amongst the financial services players in the nation’s economy, little thanks to multifarious reasons, among them, recessive economy, noxious traditional belief system, unethical practices by operators, poor image and, of course, ineffective regulation.

These bogging factors have limited the scope of insurance growth in the country as compared to its peers in other climes where the industry is the pivot of economic growth and social stabilization.

Although the industry’s players and the regulator appeared to have put their fingers on these militating factors against its growth, the pathway for surmounting the challenges seem to have been strewn with some difficulties.

Many operators, made up of insurance underwriters, Brokers, Loss Adjusters, Reinsurers and Agents have had a convergence of views about their expectations of better regulation from the government regulatory agency- the National Insurance Commission (NAICOM).

This expectation could not be said to be out of place, going by the dissonance between the regulator and some of the operators in recent times.

Some argued that what the industry had witnessed before the advent of the present leadership was something akin to a grave yard silence, due to what they regarded as “harsh regulatory prescription” occasioning icy relationship between the operators and NAICOM.

For instance, on the Insurance Brokers side, many of the operators have had to contend with huge fines and penalties for minor infractions, warranting the Nigerian Council of Registered Insurance Brokers (NCRIB) to invent a mediatory platform to reduce the life threatening policies towards its members.

Also, insurance underwriters have their tale of woes to tell from similar fines and penalties from the Commission.

Much as it is necessary to sanitise the industry and heal it of its impurities, operators held the view that regulations should be with a better human face to have desired effect.

The frosty relationship between the regulator and the operators was quite evident in the contemplated legal cases intended at some point by the NCRIB against the Commission on the proposed implementation of the States Insurance Providers (SIP) perceived by Brokers as a death knell to their already fragile existence.

Also, the insurance underwriters under an anonymous group challenged the decision of the Commission on its directive on the Tier-based capitalization in court.

These situations besmirched the reputation of the industry more in the eyes of the public as an industry that is not at peace with itself and compounded its challenges of better appeal from the public.

Happily today, the environment in the industry has become more clement, with the hope of more steady progress based on understanding and consensus building under the current leadership of the Commission.

In recent times, the Commission has been involved in more friendly and pragmatic regulations devoid of the usual “headmaster-pupil relationship” that it was noted for.

Consultation seems to have now become the norm between the regulators and the operators for a better industry. Even though the industry, particularly underwriters had been on the heat concerning the need for them to meet the deadline for recapitalization initially set for June 30, 2020, a circular from the Commission indicated that “following a review of recapitalisation plans by the operators and various levels of the compliance observed” there was the shifting of the deadline to December 31, 2020, a step that has received laud plaudits from cross session of operators, financial services experts and shareholders.

Many were of the view that the initial June 31, 2020 deadline had put the underwriters on the edge because they perceived it could lead to loss of operational profits, giving more minuses to the already fragile state of the insurance industry.

On another thought, some are of the opinion that the postponement should be taken with more seriousness by operators to avoid losing steam with the drive for funds, only to be cut up with the new date suddenly. But while the breeze of hope was blowing across the underwriters divide, the Insurance Brokers and Loss Adjusters are also coasting in on the euphoria of the extension of their practicing license renewal with the Commission to two years as against the yearly exercise. It is believed that the new regime would remove the drudgery involved in the renewal process which often impede their concentration on the core task of growing their businesses and act as a disincentive to their professional practice.

While the challenges of growing the insurance industry through diligent prosecution of the law on compulsory insurance and ensuring financial inclusion across for the industry is squarely facing the Commission, the present style of leadership of the Commission is likely to take the industry to its desired destination. As a practical step to achieving sectoral embrace of insurance, it is heartening that NAICOM had in recent times been engaging critical stakeholders such as the Lagos Chambers of Commerce and Industry (LCCI), held meetings with Insurance Directors on a regular basis and diverse insurance consumers across the country.

Since it is often said that the buck rests on leadership, whether positively or negatively, substantial credits has to go the Acting Commissioner for Insurance, Mr. Sunday Thomas for applying the Midas touch towards regulating the industry in the past few months of his ascension. Suffice it to state that Thomas has been properly seasoned for the task on hand, having served in the Commission for close to three decades and rose steadily to become the Director Technical, a position from which he retired with infallible track records of achievements in his trail. Definitely, his appointment as the Director-General of the Nigerian Insurers Association (NIA) after leaving NAICOM gave him more penetrative insight into the activities of the Association, regarded as one of the critical cornerstones of the insurance industry in Nigeria, before providence railed him back to NAICOM as the Deputy Commissioner in charge of Technical before his present position.

There is no doubt that if the present environment of amity, consensus building and empathy that have characterized the operations and disposition of NAICOM towards insurance operators persists, it would just be a matter of time for the insurance industry to experience the much desired sustainable growth, for which great credits would go to the present leadership of the Commission under Sunday Thomas and his dynamic team.

Tope Adaramola is with the

Nigerian Council of Registered Insurance