By Bisi Bamishe

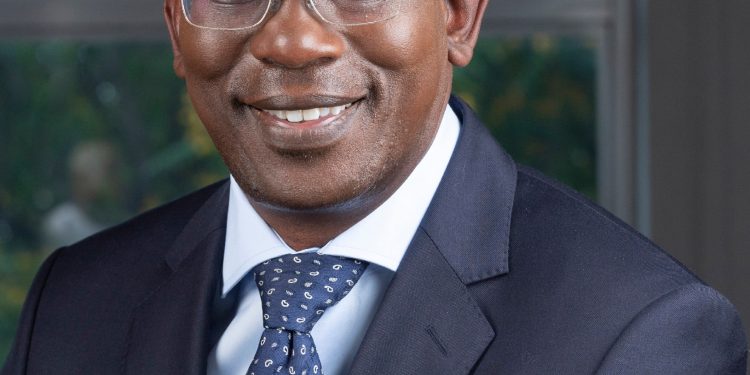

CEO

ICEA LION Holdings

Insurance regulators and operators in Africa have been enjoined to adopt ESG (Environmental-Social-Governance) to drive sustainable growth of the market on the continent.

The clarion call was made by Mr. Philip Lopokoiyit, CEO of the ICEA LION Holdings at the recent 2022 Insurance Directors’ Conference held at the College of Insurance and Financial Management (CIFM) in Lagos, Nigeria with the theme: Transforming the Insurance Industry through ESG Principles: Directors’ Roles.

Speaking on ESG Integration in the African Insurance Industry, Lopokoiyit said the key substance of the Nairobi Declaration on Sustainable Insurance was a declaration of commitment by African insurance industry leaders to support the achievement of the UN Sustainable Development Goals (SDGs).

He emphasised that the declaration is “an Africa-focused initiative designed to encourage and support African insurance market players.” He further added that “It is a convening tool that signals their willingness to develop ESG principles and solutions within their businesses as insurance players become change agents in light of the biggest challenge facing humanity.”

The ICEA LION Group executive said the declaration is important because while the UN Sustainable Development Goals (SDGs) are gaining momentum, progress to meet these SDGs from a financial services perspective was not yet at the speed or scale required.

Lopokoiyit added that the ICEA LION Group went to COP 27 in Sharm El-Sheikh-Egypt 2022 as a founding signatory to the Nairobi Declaration on Sustainable Insurance (NDSI).The Group co-hosted a Climate Adaptation event together with UNFCCC, FSD Africa and Namib Re as representatives of the NDSI on 9th November 2022. At this event, the signatories announced the launch of the Africa Climate Risk Facility. According to the ICEA LION Holdings CEO, the signatories made a commitment to insure cumulatively more than 1.4 billion people by 2030 as well as provide $14 billion insurance capacity for flood, drought & cyclones in Africa. He described the $900 million multi-donor-trust fund facility, which when fully set up and resources mobilized, will be available for NDSI signatories. The facility will drive premium subsidies, product development and capacity building. According to the executive, other significant milestones for the continent at COP 27 included the launch of the Africa Carbon Markets Initiative as well as the decision by developed countries to establish a loss and damage fund.

In terms of challenges of enthroning the ESG model in Africa, Philip identified six major roadblocks as heavy carbon-driven economies, few African voices on the issue, considerable lack of knowledge & awareness, uneven playing field for early-adopters of ESG, short-term planning models and lack of green finance instruments to quickly facilitate adoption of ESG principles.

It is imperative to emphasise that the ESG model suggested by the executive reflected prominently in the 16-point communique released by the event organisers, underlining the importance and strength of the Group’s participation at the event.

The ESG principles canvassed by the CEO of ICEA LION Holdings that got a buy-in in the final communique include the following:

· That insurance can serve as a veritable tool to solve sustainable challenges such as: Pollution, Poverty, Social Inequality, Biodiversity, Climate change, among others.

· That the Nairobi Declaration on sustainable Insurance should be given serious consideration by the Nigerian insurance industry.

· That the outcomes of COP 27 can facilitate Nigerian market expansion.

· Incentives that will address the various challenges posed to ESG should be provided by NAICOM.

· An acknowledgement that climate change has inflicted serious negative effect on the environment hence sustainability should be integrated into all investment decisions of insurance firms.

· ESG performance should occupy the top of the corporate agenda and it should be of interest to all stakeholders and more importantly directors.

· ESG principles can lead to sustainable business by incorporating toolkits that guide the business in the context of the environment. This will ensure that insurance business is carried out responsibly.

· Board members must constantly be trained in the areas of sustainability, ESG, CSR and Corporate Governance