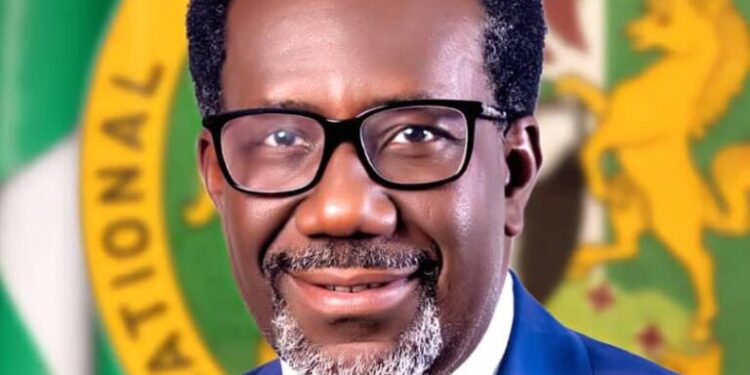

REMARKS BY THE COMMISSIONER FOR INSURANCE, MR. OLUSEGUN AYO OMOSEHIN, AT THE INSPENONLINE RETIREMENT SUMMIT HELD AT THE NECA HOUSE, ALAUSA, IKEJA, LAGOS STATE, ON WEDNESDAY, MAY 7, 2025.

Protocol,

Distinguished guests, industry stakeholders, colleagues, ladies and gentlemen,

It is my pleasure to address you at this year’s Inspenonline Retirement Summit, a platform that continues to bring important conversations around financial security, pension systems, and the welfare of retirees to the fore.

The theme for this summit, “Attaining Good Retirement Amid Economic Headwinds”, is timely and thought-provoking. It invites us to reflect deeply on the growing complexities retirees face in an era defined by inflationary pressures, market volatility, and shifting demographic patterns.

The reality today is that more individuals are approaching retirement with concerns about income sustainability, healthcare costs, and the adequacy of their pension savings. These economic headwinds are not merely statistics; they represent the lived experiences of millions of our citizens. As regulators, insurers, pension administrators, and policymakers, we must rise to this challenge with innovation, empathy, and resilience.

From the insurance sector’s perspective, retirement planning must be rooted in long-term financial protection and risk management. Products such as annuities, life insurance, and retirement savings plans are not just financial instruments, they are vital tools for peace of mind in later life. We must work to ensure these tools are accessible, transparent, and aligned with the evolving needs of our aging population.

The economic headwinds we face today are not insurmountable. But they require coordinated action, strategic foresight, and above all, trust. Trust in our institutions, trust in our systems, and trust in our financial instruments.

To navigate this period effectively, we must focus on three critical priorities:

1.Policy Alignment and Regulatory Reform: We must ensure that our policies across the insurance, pension, and financial sectors are not working at cross-purposes. Regulation must be enabling, responsive, and focused on long-term value rather than short-term gains.

2.Product Relevance and Accessibility: industry must invest in designing affordable, relevant, and inclusive retirement products, especially for the informal sector, which constitutes a significant portion of our population. Micro-insurance and digital platforms hold tremendous potential in this regard.

3.Financial Literacy and Consumer Empowerment: We cannot build a resilient retirement system without informed and empowered citizens. Early education on retirement planning, insurance benefits, and risk management must become a core part of our national strategy.

At the National Insurance Commission, we remain committed to deepening insurance penetration, strengthening consumer confidence, and fostering partnerships across the financial services system. We are actively engaging with stakeholders to develop frameworks that enhance the integration of insurance and pension systems, especially in addressing longevity risks and post-retirement income security.

Moreover, financial literacy remains a cornerstone of our collective efforts. A well-informed citizenry is better positioned to make sound retirement decisions, and it is our duty to empower them with the right knowledge and options, early and consistently.

I commend Inspenonline for convening this important dialogue. As we deliberate today, let us be reminded that retirement is not an end, it is a new phase of life that should be marked by dignity, independence, and well-being.

Let us collaborate, innovate, and advocate for policies and practices that will ensure every Nigerian retiree has not just the means to survive, but the resources to thrive.

To all participants, I urge you to approach today’s discussions with purpose, curiosity, and a sense of national duty.

Retirement is not the end of the road; it is the beginning of a new chapter. Let us work together to ensure that chapter is one of hope, not hardship.

On behalf of the National Insurance Commission, I wish us all fruitful deliberations.

Thank you and God bless you all.

Olusegun Ayo Omosehin

Commissioner for Insurance/CEO