By Bisi Bamishe

Participants who will attend the upcoming IPEN Insurance and Pension Roundtable 2023, stand a chance to win free Insurance cover.

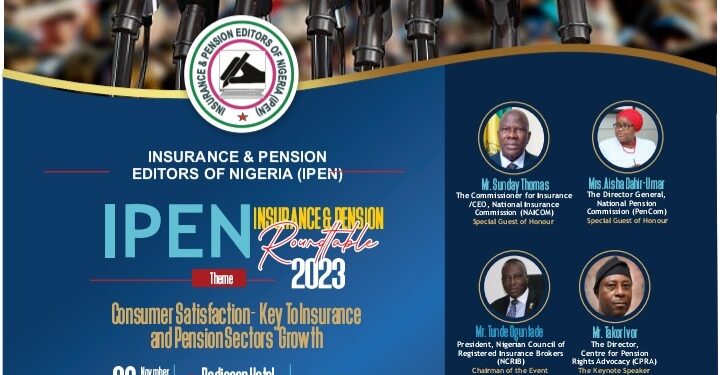

The Roundtable, which will take place on Thursday, 23rd of November, 2023 at Radisson Hotel, Isaac John, Ikeja, Lagos, by 10:00am has its theme as: ‘Consumer Satisfaction, Key To Insurance and Pension Sectors Growth.’

To this end, the free Insurance cover is under the Insurfeel initiative of Inspenonline,

The publisher of Inspenonline, Chuks Udo Okonta, said, Insurfeel was designed in line with – ‘The Suya Seller Strategy’ – which entails tasting before buying. It stemmed from a research conducted which showed that people who have had positive experience on how insurance works seem to believe and easily embraced the system.

This research, he said. therefore, necessitates the need to extend insurance experience to more people so as to deepen insurance penetration, provide safety and enhance insurance industry’s profitability.

Okonta, who is also the president of IPEN, said, “Insurfeel is targeted towards specific individuals, such as; Students in secondary schools, teachers and people with distinct impact on lives and the society. They would be selected due to their outstanding performance and contributions to human growth.

According to him, initiative is opened to people committed to philanthropy. “It is my belief that insurance remains one of the best instruments to fight poverty and make the society a comfortable place for Mankind,” Okonta said.

Through Insurfeel, he stressed that, organisation can by means of Corporate Social Responsibility (CRS) donate insurance policies as souvenir and gifts to deserving members of the public.

Groups such as Non Governmental organizations (NGO) committed to improved wellbeing of the citizenry should leverage Insurfeel to assist the need mitigate their risks.

He urged Insurance companies should leverage Insurfeel to donate their products as against the present trend where products from other sectors are donated to the public.

Meanwhile, stakeholders in the financial service sector are expected to converge at the

IPEN Insurance and Pension Roundtable 2023 to provide solutions on how to resolve pain-points of insurance policyholders and pension subscribers in the country.

The Insurance and Pension Editors of Nigeria (IPEN) is a group of developmental journalists who have decades of experience reporting the insurance and pension sectors nationally and internationally.

To this end, experts from the insurance and pension sectors as well as relevant stakeholders, including consumer groups have been invited to deliberate on the theme extensively.

To make the event live up to expectations, the new President of the Nigerian Council of Registered Insurance Brokers (NCRIB) who is also the Managing Director/CEO, Lectern Insurance Brokers Limited, Mr. Tunde Oguntade is to chair the epoch event.

The Director, Centre for Pension Rights Advocacy (CPRA) Mr. Takor Ivor is the Keynote Speaker while the Commissioner for Insurance/CEO, the National Insurance Commission (NAICOM), Mr. Sunday Thomas and the Director General, National Pension Commission (PenCom), Mrs. Aisha Dahir-Umar are Special Guests of Honour.

The panelists who will discuss the theme include: Mr. Olasupo Sogelola, Managing Director/CEO, International Energy Insurance (IEI) Plc; Mrs. Thaibat Adeniran, MD/CEO, Hilal Takaful Insurance; Mr. Kazeem Odewunmi, President, Association Of Registered Insurance Agents of Nigeria (ARIAN) and Mr. Rotimi Adebiyi Managing Director and Chief Executive Officer of Crusadersterling Pensions Limited.

Various consumer groups have indicated interest to attend the roundtable which will serve as opportunities for Insurance companies and Pension Fund Adminstrators(PFAs) to market and service them appropriately.

Speaking on the development, the president of the group, Mr. Chuks Udo Okonta said the theme is apt as insurance and pension sectors are repositioning to offer consumers better service delivery to deepen penetration.

For the insurance sector, he noted that, several reasons have been adduced for poor insurance penetration in Nigeria ranging from the country’s peculiar market environment, limited public awareness and negative public perception by those who are unaware of insurance. But in the reality, inadequate service delivery is a major challenge to why insurance acceptance has been very low, he stressed.

According to him, “On the other hand, the need for service delivery in the pension sector is key for the overall success of and sustainability of the Contributory Pension Scheme (CPS), considering its retail nature. Achieving service excellence in the sector is a collective effort by all stakeholders to ensure enhanced service delivery.”